A business exit strategy is an entrepreneur's strategic plan to sell his or herownership in a company to investor's or another company. An exit strategy gives a business owner a way to reduce or liquidate his stake in a business and, if the business is successful, make a substantial profit. If the business is not successful, an exit strategy (or "exit plan") enables the entrepreneur to limit losses.

Ideally, an entrepreneur will develop an exit strategy in their initial business plan before actually going into business, or in their early growth stage. The choice of exit plan can influence business development decisions. Common types of exit strategies include initial public offerings (IPO), strategic acquisitions, and management buyouts (MBO).

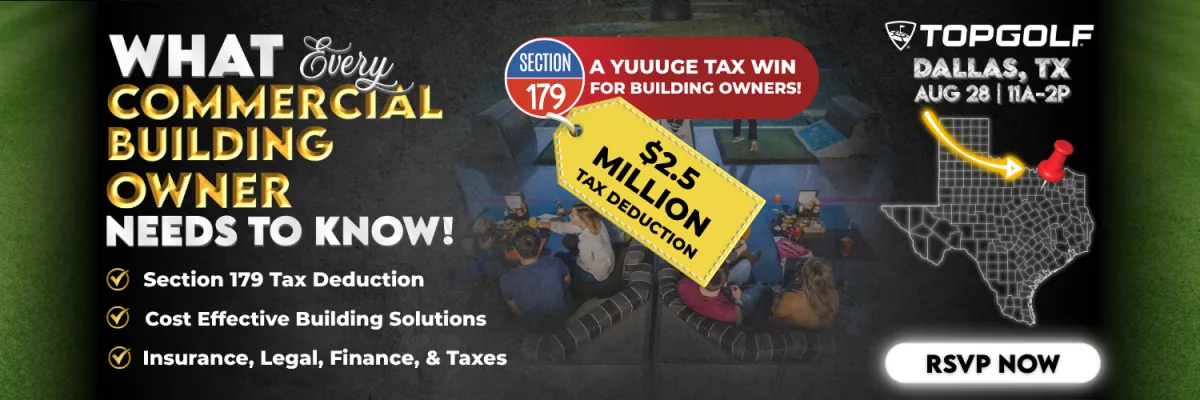

A powerful new tax law signed on July 4, 2025, has opened the door to up to $2.5 million in immediate deductions through the Section 179 for Commercial Building Owners.

Whether you’re a Building Owner, Property Manager, Asset Manager, or REIT Decision-Maker ... this "lunch-n-learn" networking event is built for you.

You’ll hear from experts in Tax, Finance, Insurance, and Construction — walk away with strategies to reduce taxes, unlock cash flow, and improve your properties.

UPCOMING EVENTS - TEXAS

WHAT YOU WILL LEARN ...

How to Leverage the New Section 179 Tax Law (Signed July 4, 2025)

Discover how recent legislation can unlock up to $2.5 million in immediate tax deductions for capital improvements on commercial properties.

Smart Tax Strategies from a Leading Tax CPA & Section 179 Pro

Gain expert insight into how to structure your deductions for maximum benefit—and avoid red flags.

Which Building Upgrades Qualify for the Deduction

Learn from a seasoned commercial contractor exactly what types of building improvements (Roofs, HVAC, Building Upgrades, Interior Buildouts, and More!) that make the cut funder the new rules!

Financing Solutions for Big Projects Without Big Cash Upfront

Get guidance from a commercial finance expert on low-risk funding options for large-scale improvements, allowing you to wipe out up to $2.5M of taxable income in other parts of your business portfolio.

How to Use Insurance Claims to Fund Capital Improvements

Hear from an insurance attorney on how to tap into past, existing or future claims., and use the Section 179 Tax Deduction to wipe out up to $2.5M of taxable income in other parts of your business portfolio.

Network with Industry Experts and Peers

Connect with other building owners, commercial property managers, facility, asset, or portfolio managers, and REIT stakeholders who are capitalizing on these new strategies.

FIRST COME - FIRST SERVE!

YOUR RSVP INCLUDES:

Full Access to our Panel of Experts at Top Golf - Dallas on AUG 28 (11A-2P).

Complimentary Steak Fajita Luncheon w/Speakers & Attendees.

Complimentary Golf Bays, Cold Beverages, & Networking (2P-5P).

COMPLIMENTARY "FAJITA FIESTA!"

TOPGOLF DALLAS (11A-2P)